Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

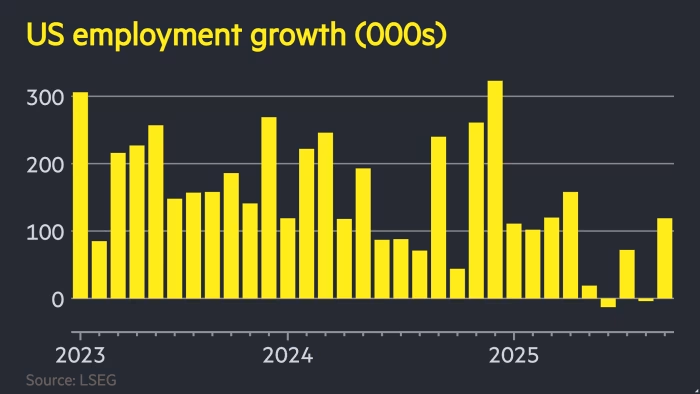

The US added 119,000 jobs in September but unemployment reached its highest level in four years, in figures that will complicate the Federal Reserve’s decision on whether to cut interest rates next month.

Thursday’s jobs number was far greater than the expectations of 50,000 new posts among economists polled by Bloomberg. But it was offset by downward revisions of 33,000 to the previous two months’ tallies.

August’s figure was revised to a loss of 4,000 jobs, marking just the second time since the Covid-19 pandemic that the US economy has shed positions.

The unemployment rate, meanwhile, rose from 4.3 per cent in August to 4.4 per cent in September, the highest level since 2021.

The data release is the first indicator of the health of the US economy from the Bureau of Labor Statistics since a record-length shutdown of the federal government halted publication of official data.

The mixed report sets the stage for a clash between hawkish and dovish members of the Federal Open Market Committee when they meet next month to decide whether to cut interest rates for a third time this year.

Austan Goolsbee, an FOMC voter who heads the Chicago Fed, told journalists on Thursday afternoon the jobs report showed “pretty strong stability” and “did not seem to suggest that there’s a rapidly deteriorating labour market”.

“There’s something in this report for everyone — hawks can point to acceleration in hiring, doves can point to the higher unemployment rate,” said Eric Winograd, senior economist for fixed income at AllianceBernstein.

He put the chances of a December rate cut at 50/50 but added that the Fed saw the unemployment rate as the “best barometer of supply and demand in the labour market”.

In a further sign of how the jobs market has moderated in recent months, downward revisions to employment figures leave combined hiring from May to August at just 74,000.

US President Donald Trump has long campaigned for the Fed to cut rates, insisting policymakers are depressing the economy with borrowing costs that have been in restrictive territory for years.

The White House seized on the positive aspects of Thursday’s release, which it said provided evidence of the success of the president’s policies.

“This strong report is more proof that President Trump’s pro-growth, America First agenda is already making great progress, and it will continue to deliver positive results for American families and businesses,” said Karoline Leavitt, White House press secretary.

The unemployment rate and hiring figures come from separate surveys carried out by the BLS, one tracking households and the other businesses.

US Treasury yields and the dollar both dipped following the report, though the latter managed to swing back into positive territory. Equities were volatile as an early rally faded, leaving Wall Street’s main indices closed in the red.

The Fed has lowered borrowing costs by 0.25 percentage points twice this year but a deep schism has developed between those in favour of a cut at its December meeting to bolster the labour market and others concerned about the risk of stoking inflation.

Patrick Locke, analyst at JPMorgan, said it was “not easy to know what to make of this report, with conflicting directional moves across underlying indicators”.

“It doesn’t seem as though there’s a smoking gun to lock in a December decision,” he added.

Several indicators have pointed to the risk of mounting job losses in the months ahead.

The Cleveland Fed said this week that lay-off notices surged in October, with more than 39,000 warnings of impending job losses issued across the 21 states it tracks. The figure is among the highest since it began tracking the data in 2006.

Verizon, the US telecoms giant, on Thursday began cutting 13,000 jobs, according to a letter from chief executive Dan Schulman to employees, which was seen by the Financial Times.

A spokesperson said: “This is an opportunity for Verizon to reset, restructure and realign our priorities in ways that will help us regain our leadership as a communications provider.”

The Fed’s decision-making has already been complicated by the shutdown, which has prevented the release of regular economic reports.

The BLS said on Wednesday it would not release a jobs report for October as the shutdown had stopped it from collecting data for the month. Some data for the period will be included in the November report, which will not be released until after the Fed’s December meeting.

Additional reporting by Peter Wells in New York