Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

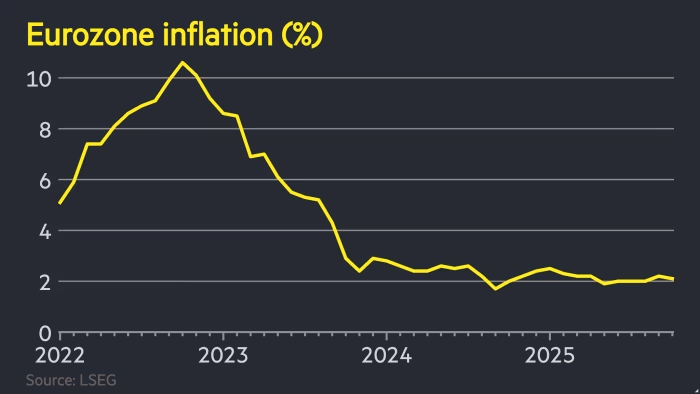

Eurozone inflation dipped to 2.1 per cent in October, hovering above the European Central Bank’s 2 per cent target for the second month in a row.

Friday’s flash estimate of the annual inflation figure for October was in line with economists’ forecast in an LSEG poll and below the 2.2 per cent recorded in the previous month.

The data comes a day after European Central Bank president Christine Lagarde said the outlook for inflation in the bloc was “broadly unchanged”.

Core inflation, excluding volatile food and energy prices, remained consistent with September’s level of 2.4 per cent.

The closely watched figure for services inflation — a gauge for domestic price pressures that has remained well above the ECB’s 2 per cent target for more than three years — rose to 3.4 per cent, the highest level since April and 0.2 percentage points higher than in September.

Diego Iscaro, analyst at S&P Global Market Intelligence, said that the uptick in service prices was “likely to give ammunition” to hawkish voices on the ECB’s governing council, who argue for caution.

The Eurozone’s third-quarter economic growth was slightly better than expected at 0.2 per cent.

Lagarde highlighted the continued growth when the ECB left its benchmark interest rate at 2 per cent for the third consecutive meeting on Thursday after eight cuts that halved borrowing costs in a year.

Bets on future interest rate cuts were broadly unchanged following the inflation reading. Traders put an approximately 40 per cent probability of a quarter-point rate reduction by June 2026, according to levels implied by swaps markets.

Francesco Pesole, FX strategist at ING, said October’s inflation data was “simply confirming the ECB isn’t going to cut again”.

The euro was little moved against the dollar at $1.157 after the release, and was broadly flat on the day.